Remarkable Homes, Inspired Living Through Real Estate Primary Residency

Unlock the full potential of your property investments. Our strategic approach focuses on fining the best location to fit into your family needs while maximize the appreciation property and value.

About Us

At JJU Realty, we’re a husband-and-wife team of real estate agents and investors with over 20 years of combined experience helping clients achieve financial freedom through smart, sustainable real estate investing — starting with the most affordable entry point: your primary residence.

From personal homes to long-, mid-, and short-term rentals, and from land acquisition to commercial properties, we help you create passive income, long-term appreciation, and a clear, strategic path toward lasting success.

Our mission is simple: to make your real estate journey smooth, informed, and rewarding — one property, one smart move at a time.

Meet Our Team

Trey Underhill

Services

Buy Property

Although some renters believe that renting is “maintenance free”, they are actually paying for maintenance in their rent – whether they need it or not. Renting offers you no equity, no tax benefit, and no protection against regular rent increases. If you are paying rent, you are really just paying someone else’s mortgage. Writing a check is just like watching your hard earned money sail away. Let’s compare together.

Sell Home

If you’ve been thinking about selling your home, but wanted to wait to list it until the housing market recovered, you’re in luck. Home sales are up, and buyers are chomping at the bit to purchase a great home that fits their needs—perhaps one just like yours. Want to know your property value, give us a call and we will provide a free house evaluation.

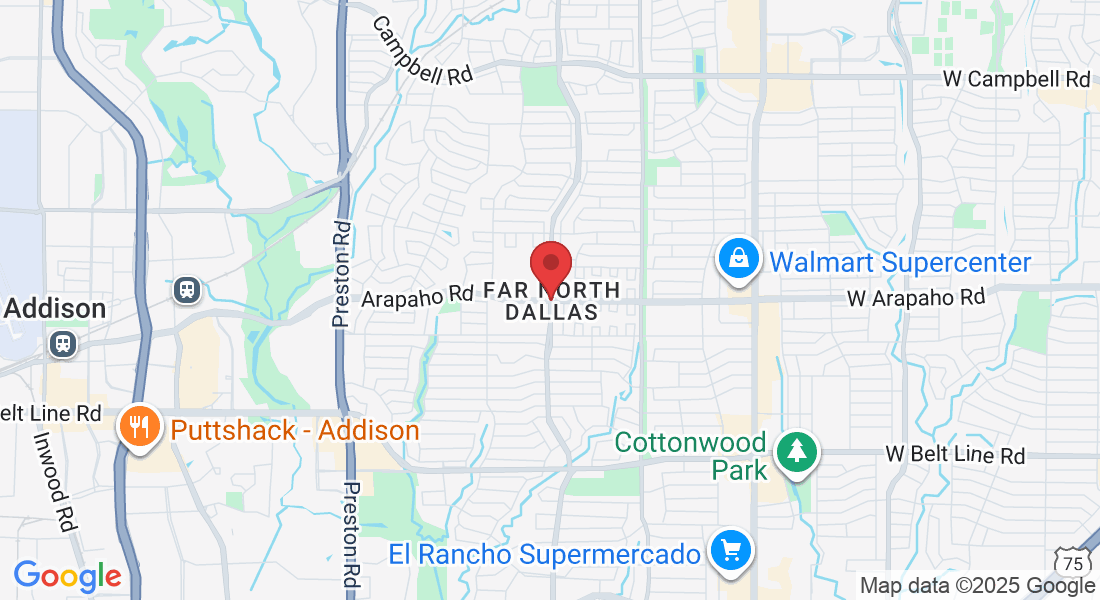

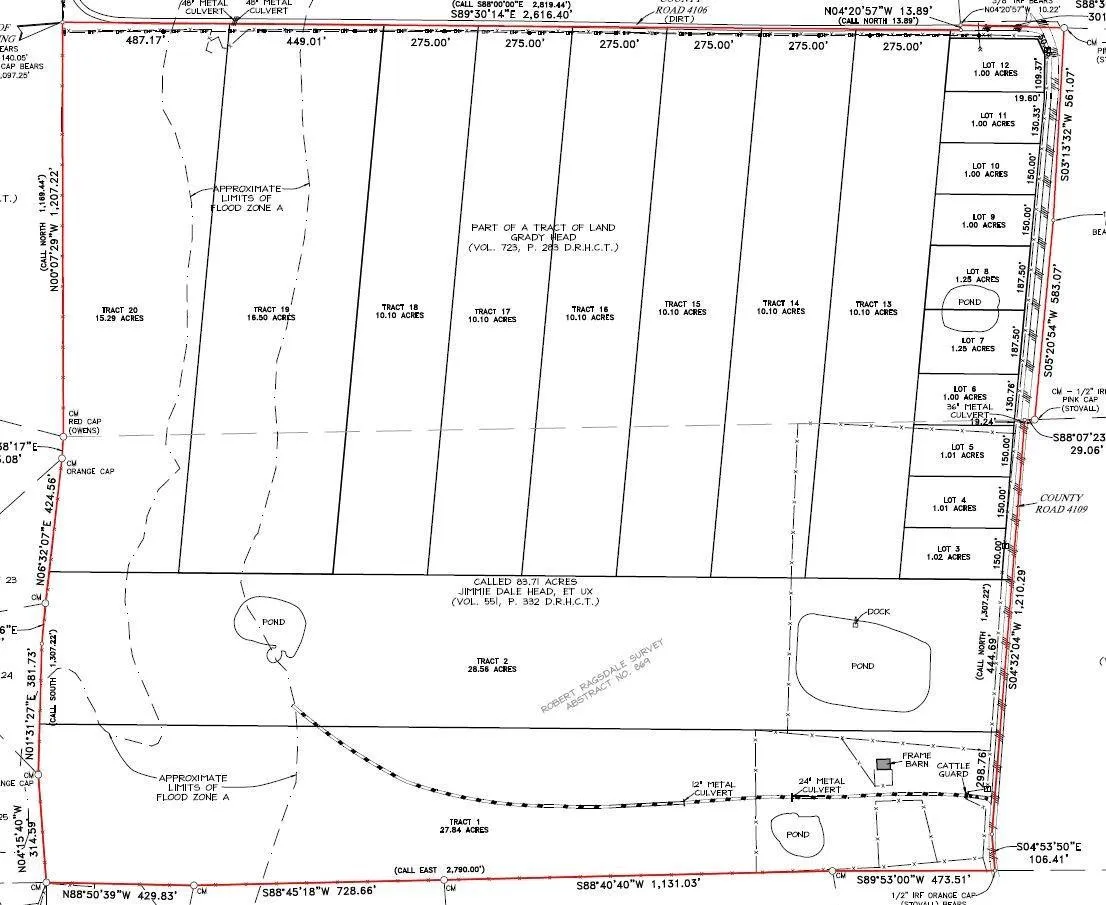

Purchase Land

At JJU, we offer specialized land development consulting services, partnered with the best in the industry, that empower property owners, developers, and investors to transform raw land into thriving, well-planned communities and commercial developments.

Property Management Consultation

From long-, mid-, to short-term rentals, we figured a system for each and would like to show you how.

Check out our properties in desirable travel destinations. If you like what you see, please schedule a free consultation. We can assist with design, setup, and management, all with data and experience.

Triple Net Commerical Property Investment

Tired of rising property taxes and insurance costs eating into your returns? A Triple Net (NNN) property might be the right investment strategy for you.

Curious about how it works, what cap rate is ideal in today’s market, or how to balance the risks and rewards?

Let’s talk — we’ll help you evaluate opportunities that align with your financial goals and long-term strategy.

Our Preferred Partners

Celeste Hamid

Emily Chen

Lee Warren

FAQS

What is a good market to invest?

Identifying markets that exhibit strong fundamentals in the following areas is the very first step to real estate investing. By starting investing with these markets you can eliminate a lot of markets that won’t make sense financially and narrow your search down to areas that have a promising future. Areas that offer the best returns, have the best outlook, and have the strongest growth potential.

1. Strong employment with multiple industries represented

2. Typically a reasonably sized population (1 million+)

3. Strong population growth

4. Landlord friendliness states

4. Low cost of living

5. High rent desirability

6. High rent-to-value ratios (Rent-to-value = amount of rent you get per $1 invested)

How to find market trend?

After finding the market, it is key to understand the market trend in that city. One of our goals is to provide information so you can make the best real estate investing decisions. Each month we will publish a market report covering the following topics.

1. Property prices, number of units sold, inventory level, days on market, and discounts.

2. Lending updates

3. Interesting local news articles

4. Notes from real estate conferences

5. Rental data: rent growth, vacancy, average rents, etc

How to know where you want to live in a city?

When it comes to where you want to live in a city, it is essential to know what you want. We have some questionnaires to help you identity you wants and needs. We match that with what the market can offer and provide clear directions.

Testimonials

I've been working with JJU Realty for several years now, and I couldn't be happier with their services.

Mr. Jing Yu